IRS Child Tax Credit Letter: What You Need to Know

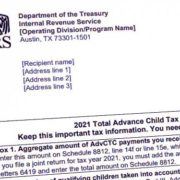

Taxpayers who received advance payments of the Child Tax Credit will receive a Letter 6419. According to the IRS website, Letter 6419 will include important details, such as the total amount of advance Child Care Tax Credit payments for 2021. The letter will also detail the number of qualifying children used to determine advance payments as well as repayment protection information needed when filing your 2021 federal tax return.

To help taxpayers stay on top of their specific Child Care Tax Credit information, the IRS began sending Letter 6419 to qualifying recipients. The intent of the letter was to advise taxpayers about the amounts they received for the advance payments of the Child Tax Credit. Unfortunately, the IRS has recently acknowledged that some Letters 6419 that were printed and mailed to taxpayers in December could be incorrect.

The cause for this issue could be the result of various factors, such as taxpayers who have moved or if their checks or direct deposit payments were not received and returned to the IRS. It’s important to be aware of the issue because reporting the incorrect advanced credit could result in:

- Inaccurate calculations regarding the remaining available credit

- Incorrect return

- Tax return processing delays.

The IRS has provided a website for the Child Tax Credit information where Taxpayers can find their up-to-date information. The other option is for the taxpayer to access their account directly with the IRS using their website. The IRS is also aware that the letters may be inaccurate for taxpayers who alternate custody of their children every other year.

Contact Leone, McDonnell & Roberts Today

If you have questions about the Child Tax Credit, Leone, McDonnell & Roberts can help. Contact our team today to discuss your needs with one of our skilled and experienced tax professionals.