NH vs. MA Supreme Court Tax Case: A Breakdown of Where it Stands

Contributed by: Robert Franger, Staff Accountant

We all know that COVID-19 stirred up a wide range of professional circumstances none of us could have anticipated before the global pandemic. For New Hampshire residents sheltering in place while remote working in Massachusetts, getting paid suddenly got complicated.

The issue at hand? Taxpayers who started working remotely in NH due to COVID-19 (either full or part-time remote work) for their Massachusetts-based employer are still being subject to Massachusetts state income tax on the wages earned while working remotely. As NH has no state income tax and MA has a tax of 5%, this could prove a substantial amount for some taxpayers.

State of New Hampshire Argued Against Massachusetts

The state of New Hampshire did not take the potential new tax burden on its citizens lightly. The state argued that their residents were not stepping foot into MA yet were still being inappropriately subject to the MA state income tax. According to their argument, as these employees were working from home and not going into MA, they should enjoy the tax-free nature of NH. Governor Sununu even stepped in, making it known that he is firmly against Massachusetts’s treatment.

The state of Massachusetts feels differently. MA believes that the regulations are temporary and wanted to maintain a status quo for the pre-pandemic tax environment. They also thought if NH prevailed that there would be substantial additional compliance burdens on employers as a result. The case went all the way to US Supreme Court. However, the court denied hearing NH’s lawsuit against Massachusetts. However, Justin Clarence Thomas and Samuel Alito both dissented to the brief order, indicating they would have listened to the case.

How could this affect you?

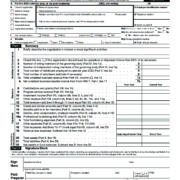

All taxpayers that worked for a MA-based company (physically located in MA) that turned to a hybrid or fully remote model should ensure that they had the 5% income tax withheld on their taxable earnings subject to Massachusetts’ income tax in line with statutory requirements. Box 15 of the W2 will show MA, and Box 16 will show the wages that should be subject to Massachusetts’ income tax – this should be in line with box 1.

Are you subject to MA taxes? Contact Leone, McDonnell & Roberts today to discuss your potential tax burden with our experienced accounting team.