So You Missed the Filing Deadline, Now What?

At Leone, McDonnell & Roberts, we never recommend missing a filing deadline. Our tax team prioritizes filing for our clients to ensure that they meet their specific requirements. However, we do recognize that sometimes, life happens and deadlines are missed. Understanding how to handle missing the filing deadline can help you understand the best way to minimize possible penalties.

The most important thing to do after you’ve missed the deadline is to file as soon as possible. As part of the process, you should consult with a tax advisor if you need assistance preparing or submitting the return. Working with a tax professional can help ensure a smooth, accurate, and expedient filing.

Other Factors to Consider When Filing Your Tax Returns Late

Many clients wonder how a late filing will impact their taxes or the amount owed. The answer depends on a few factors.

What if I have to pay additional taxes?

If you owe money on the late return, there are a few things to know. First, you may be subject to additional penalties and interest owed based on both late filing and late payment.

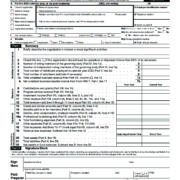

For example, if the amount of tax due on the return was $1,000, penalties and interest may look similar to this the day after the return was due:

| Tax Due | $1,000 |

| Failure to Pay Penalty | 5 |

| Failure to Pay Penalty | 45 |

| ($50 total penalty, offset by Failure to Pay Penalty) | |

| Interest | 3 |

|

|

|

| Total Amount Due | $1,053 |

However, there may be ways to reduce the total amount owed. Programs like the First Time Penalty Abatement (FTA) and others can help minimize potential penalties. You should consult with your tax advisor to determine if you qualify for this abatement and have met the following criteria listed here. Some of the qualifications for the abatement include:

- You didn’t previously have to file a return, or you have no penalties assessed for the three tax years before the tax year in which you received a penalty

- You filed all currently required returns or timely filed an extension of time to file

- You have paid, or arranged to pay, any tax due

It’s important to note that the abatement only applies to failure to file and failure to pay penalties. Interest generally cannot be abated and will continue to accrue, making it essential to file as soon as possible to minimize fees. Also, quarterly rates are set by statute and currently are about 3 percent.

But I’m owed a refund. Do I still have to file?

Taxpayers owed a refund can rest a little easier. Generally, filing late when owed a refund only results in a delay in receiving the refund payment. However, you’ll still want to file as quickly as possible to claim your refund. Refund requests for returns that are particularly late (typically three or more years past due) may have their refund denied. Please consult your tax advisor for the particulars of your case.

Whether you missed the tax-filing deadline or are already planning ahead to next year, Leone, McDonnell & Roberts can help. Contact us today to speak with one of our experienced tax professionals.